interest tax shield adalah

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Companies pay taxes on the income they generate.

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income.

. Tax shields terdiri dari Debt Tax Shield. Besarnya tax shield sama dengan tarif pajak dikalikan peningkatan beban. Tax rate perusahaan adalah 40 jadi mereka mendapatkan interest tax shield sebesar TCBrB 040600008 1920 tiap tahun.

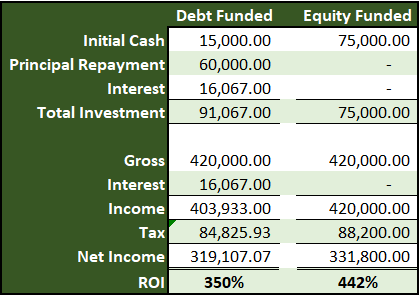

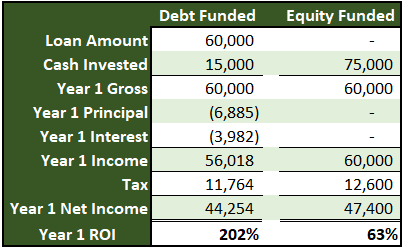

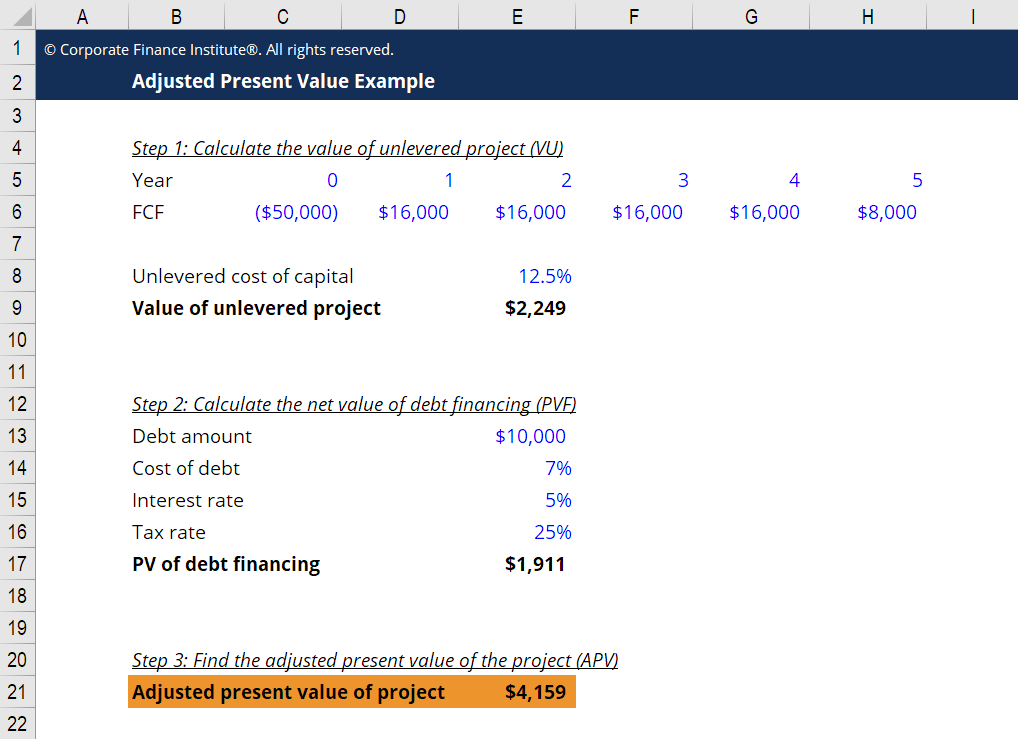

The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any financing benefits. Interest Tax Shield As the name suggests and discussed earlier the interest tax shield approach refers to the deduction claimed in the tax burden due to the interest expenses. The Interest Tax Shield Is A Key Reason Why.

The value of an unlevered firm is equal to the value of a levered firm. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation. While tax shields are used for tax savings for both personal and business tax returns this article focuses on tax shields for businesses.

Tax Shield for Individuals Individuals can also benefit from tax shields. Adjusted Present Value - APV. It shows that the T-Test in a non-debt tax shield variable is obtained by the T-calculate result of 1401 and the value of Sig.

Interest Tax Shield Example. For example a mortgage provides an interest tax shield for a property buyer because interest on mortgages is generally deductible. These deductions reduce a taxpayers taxable income for a given year or defer income taxes into future years.

A tax shield is a reduction in taxable income by taking allowable deductions. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable donations. Interest tax shields refer to the reduction in the tax liability due to the interest expenses.

This explains that if an individual or corporation has. Tax shield adalah kelompok penentu struktur modal yang dapat mengurangi atau menambah hutang. Tax shields lower the overall amount of taxes owed by an.

Karena itu bagi perusahaan beban bunga interest expense disebut juga sebagai manfaat pajak atas bunga interest tax shield. A firms cost of equity capital depends solely on the return on debt the debt-equity ratio and the tax rate. This in turn reduces the total amount of tax payable by the firm.

The interest tax shield is positive when the Earnings Before Interest and Taxes EBIT is greater than the interest payment. Thus interest expenses act as a shield against tax obligations. It is also notable that the interest tax shield value is the net present value of all of the interest tax shields.

Thus interest expenses act as a shield against the tax obligations. TOP 5 Tips The interest tax shield is a key reason why. Interest tax shields are a method of reducing taxable income by deducting the interest payments on debt from taxable income.

The reduction in income taxes that results from the tax-deductibility of interest payments. Perlindungan pajak tax shield adalah pengurangan tagihan pajak perusahaan yang disebabkan oleh peningkatan jumlah beban yang dapat mengurangi pajak biasanya depresiasi atau bunga. Interest expenses via loan and mortgages are tax deductible meaning they lower the taxable income.

Non Debt Tax Shield merupakan manfaat pajak yang didapat perusahaan selain dari. Stated another way its the deliberate use of taxable expenses to offset taxable income. 1 Whats NOT a Tax Shield.

What is the benefit of a tax shield. Interest expenses via loans and mortgages are tax-deductible meaning they lower the taxable income. Perisai pajak adalah pengurangan pendapatan kena pajak dengan cara mengklaim pengurangan yang diperbolehkan untuk biaya tertentu seperti depresiasi aset bunga atas hutang dll dan dihitung dengan mengalikan biaya yang dapat dikurangkan untuk tahun berjalan dengan tarif perpajakan sebagai berlaku untuk orang yang bersangkutan.

Companies pay taxes on the income they generate. The interest tax shield relates to interest payments exclusively rather than interest income. The interest payments can also be used to reduce the amount of income that is subject to the alternative minimum tax.

Interest Tax Shield Interest Expense Deduction x Effective Tax Rate Interest Tax Shield 4m x 21 840k While Company A does have a higher net income all else being equal Company B would have more cash on hand from its debt financing that can be spent on future growth plans benefiting from the tax savings on interest expense. The interest tax shield has no value for a firm when. Thus interest expenses act as a shield against tax obligations.

Apa itu Tax Shield. Interest tax shields refer to the reduction in the tax liability due to the interest expenses. This reduces the amount of income that is subject to tax and can result in a lower tax bill.

Ad No Money To Pay IRS Back Tax.

What Is A Tax Shield Depreciation Tax Shield Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

How Tax Shields Work For Small Businesses In 2022

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

How Tax Shields Work For Small Businesses In 2022

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Adjusted Present Value Apv Definition Explanation Examples